straight life policy formula

Next you would build a depreciation schedule and calculate values. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

The formula first subtracts the cost of the asset from its salvage value.

. The straight line depreciation for the machine would be. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. Also known as whole or ordinary life.

An insurance product that makes periodic payments to the annuitant until his or her death at which point the payments stop completely. Straight line depreciation method charges cost evenly throughout the useful life. This is the amount to be paid by life insurance firms on insurance policies.

Related

The formula for calculating Straight Line Depreciation is. Essentially 3 is added to your benefit. To calculate depreciation expense for each year you would subtract 90K from 450K and divide it by.

The formula to calculate the straight-line depreciation rate is. To calculate the area of a circle it is necessary to first determine the circles radius which is half the distance of a straight line across the center of the circle. Company A purchases a machine for 100000 with an estimated salvage value of 20000 and a useful life of 5 years.

When you purchase your straight life annuity you have the option to include a Cost of Living Adjustment COLA if inflation is a concern. Cost - Residual Value Useful Life. Straight-line depreciation for the period.

Straight line depreciation can be calculated using the following formula. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A straight life insurance policy provides lifelong coverage at a consistent premium rate.

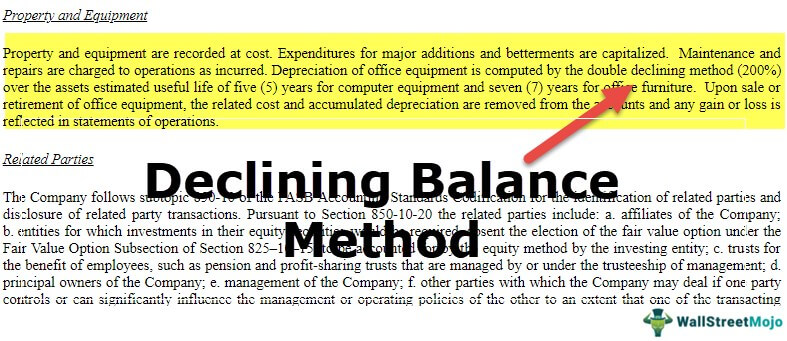

The straight-line method of depreciation posts the same dollar amount of depreciation each year. Straight life insurance is a type of permanent life insurance that provides a guaranteed death. The straight Line Method SLM is one of the easiest and most commonly used methods for providing depreciation.

Straight Life Annuity. Straight life insurance is more commonly known. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Eqstraight line depreciation rate fracannual depreciation expensecost of item - residual value of. Subtract the estimated salvage value of the asset from the cost of the asset to get the total. Cost Expected residual value.

Insurers consider the applicants age health history self and family driving records. A straight life insurance policy often known as whole life insurance has a cash value account. Top 2022 Life Insurance Plans Up to 70 off.

For instance average cost of a 20-year 100000 term life insurance policy is. Expected useful life of asset. Formula to calculate straight-line depreciation is as follows.

Straight life annuities do not include a death. After all a straight life insurance policy is much more expensive than a term life insurance plan. Straight life policy formula Friday February 11 2022 Edit.

Get Your Free Quote in 3 Minutes.

Straight Line Depreciation Accountingcoach

Carrying Amount Definition Formula How To Calculate

Calculation Of Gear Dimensions Khk

Salvage Value Formula Calculator Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Accountingcoach

Straight Line Basis Definition

Loss Ratio Formula Calculator Example With Excel Template

Double Declining Balance Method Of Deprecitiation Formula Examples

Useful Life Definition Examples What Is Asset S Useful Life

Straight Line Depreciation Efinancemanagement

Loss Ratio Formula Calculator Example With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods 4 Types Of Depreciation You Must Know

Straight Line Depreciation Formula Guide To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense